Menu

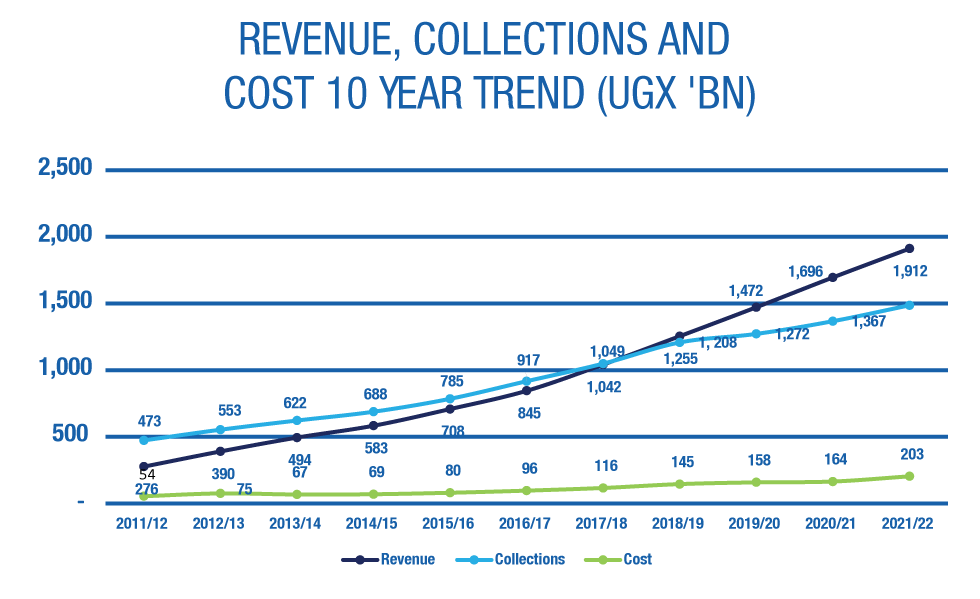

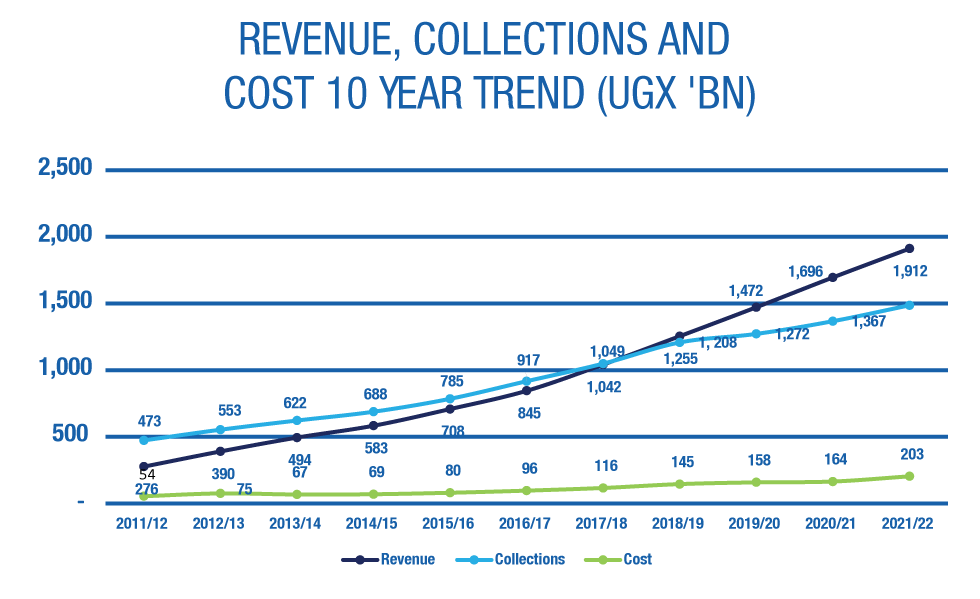

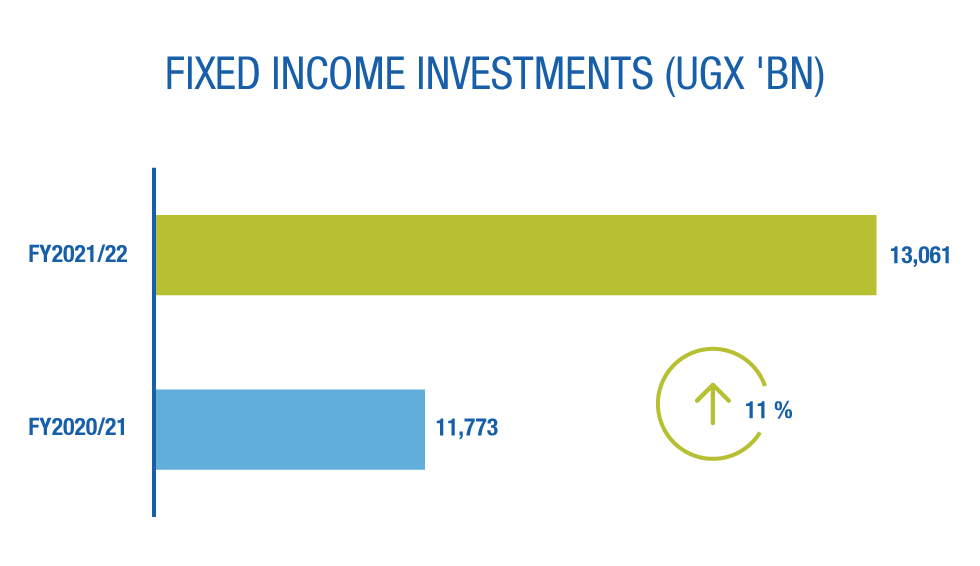

As a result, total realised revenue grew by 13% from UGX 1,696Bn to UGX 1,912Bn driven by the growth in Fixed Income and Dividend Income growth.

As a result, total realised revenue grew by 13% from UGX 1,696Bn to UGX 1,912Bn driven by the growth in Fixed Income and Dividend Income growth.

Annual operating costs amounted to UGX 203Bn, up by 24% from UGX 164Bn in FY2020/21 and 5% above the budget of UGX 194Bn. This was driven by the changes from the organisational redesign to align the Fund’s operations with the opportunities presented by the NSSF Amendment Act 2022 in addition to the general increase in prices of goods and services.

Consequently, the annual cost-to-income ratio stood at 11.4% in FY2021/22, up from 8.9% in FY2020/21. The expense ratio increased to 1.18% in FY2021/22 from 1.06% in FY2020/21. This was higher than the target of 1.15%.

Whereas revenue and collections have grown by a compound annual growth rate (CAGR) of 21% and 12% respectively, costs have only grown by a CAGR of 14% over a 10-year period (FY2011/12-FY2021/22). Revenue has posted significant growth over the historical period, and it surpassed collections from FY2018/19 onwards. In FY2021/22, revenue was higher than collections by 29% and this gap continues to grow.

Annual operating costs amounted to UGX 203Bn, up by 24% from UGX 164Bn in FY2020/21 and 5% above the budget of UGX 194Bn. This was driven by the changes from the organisational redesign to align the Fund’s operations with the opportunities presented by the NSSF Amendment Act 2022 in addition to the general increase in prices of goods and services.

Consequently, the annual cost-to-income ratio stood at 11.4% in FY2021/22, up from 8.9% in FY2020/21. The expense ratio increased to 1.18% in FY2021/22 from 1.06% in FY2020/21. This was higher than the target of 1.15%.

Whereas revenue and collections have grown by a compound annual growth rate (CAGR) of 21% and 12% respectively, costs have only grown by a CAGR of 14% over a 10-year period (FY2011/12-FY2021/22). Revenue has posted significant growth over the historical period, and it surpassed collections from FY2018/19 onwards. In FY2021/22, revenue was higher than collections by 29% and this gap continues to grow.

The Fund declared a return to members of 9.65% in the FY 2021/22 resulting in UGX 1,380Bn compared to 12.15% in FY 2020/21 which resulted in UGX 1,516Bn. The decline in the return was due to the diminishing returns because of the reduction in the funds available for long-term investment. This was due to increased benefits pay-outs from midterm access and lower returns earned from undertaking shorter-term investments to meet the midterm access obligations.

The Fund declared a return to members of 9.65% in the FY 2021/22 resulting in UGX 1,380Bn compared to 12.15% in FY 2020/21 which resulted in UGX 1,516Bn. The decline in the return was due to the diminishing returns because of the reduction in the funds available for long-term investment. This was due to increased benefits pay-outs from midterm access and lower returns earned from undertaking shorter-term investments to meet the midterm access obligations.

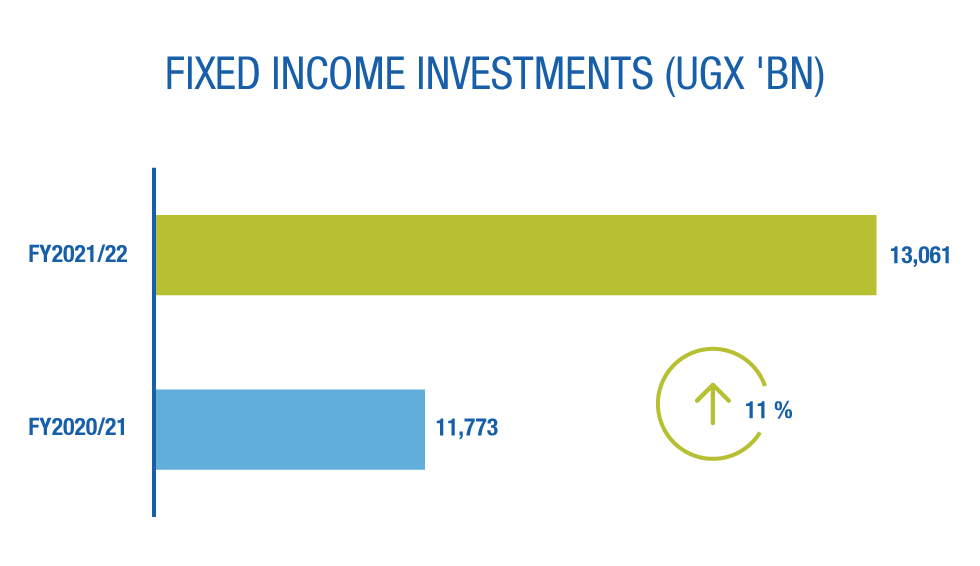

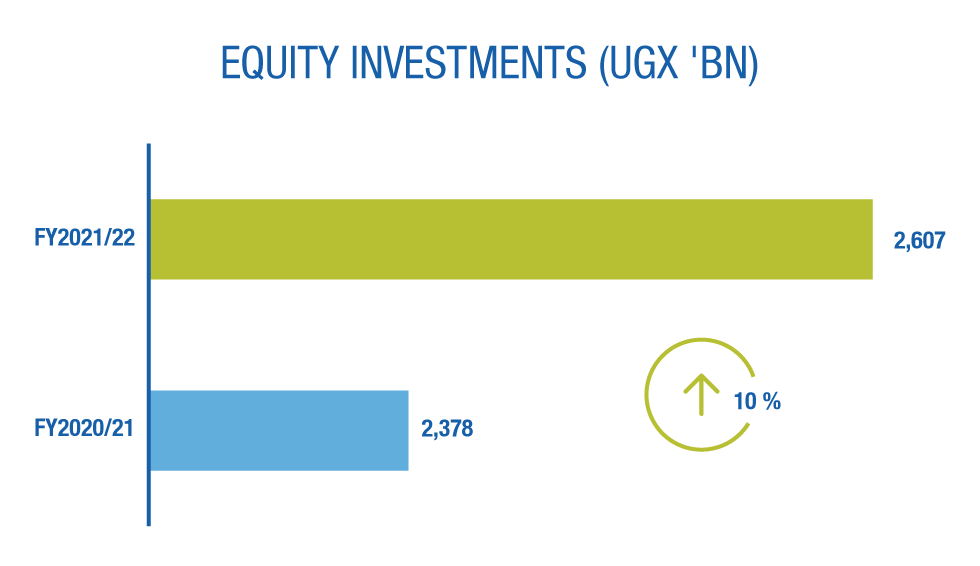

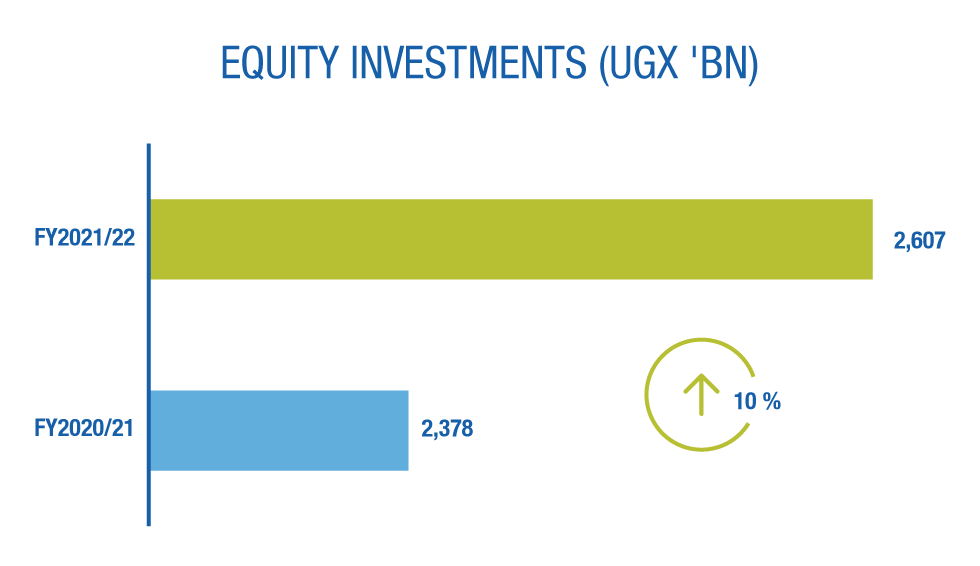

The Fund invests in 3 asset classes: Fixed Income Securities, Equity Securities and Real Estate:

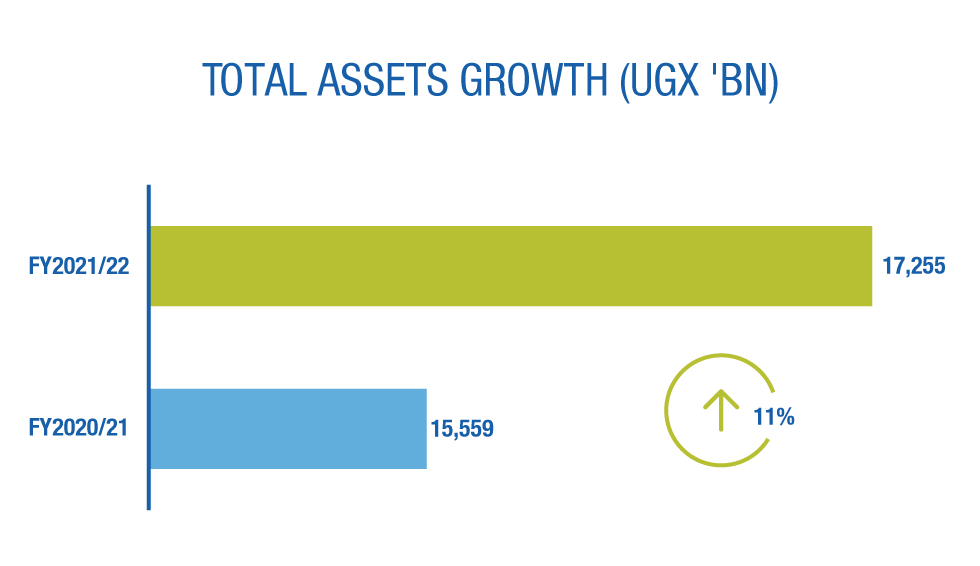

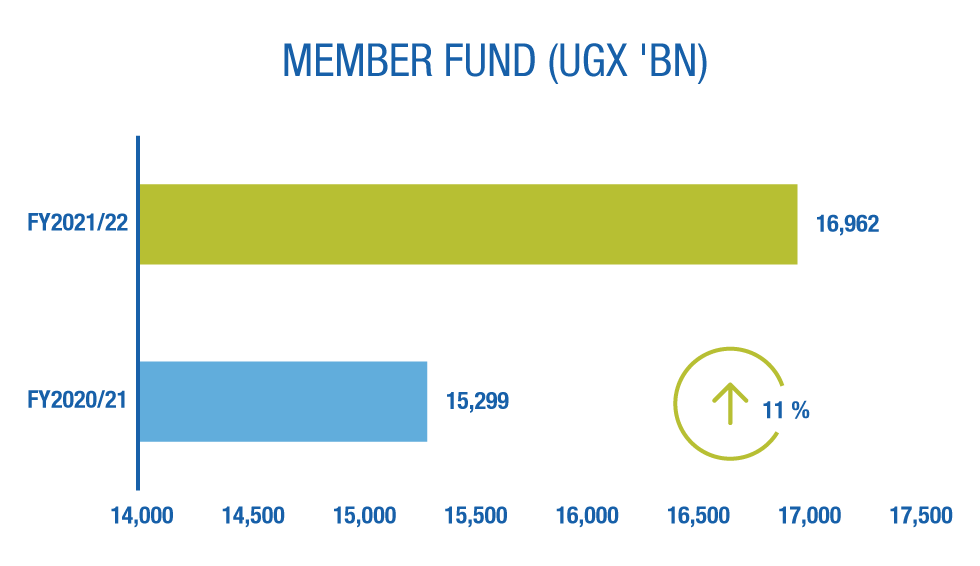

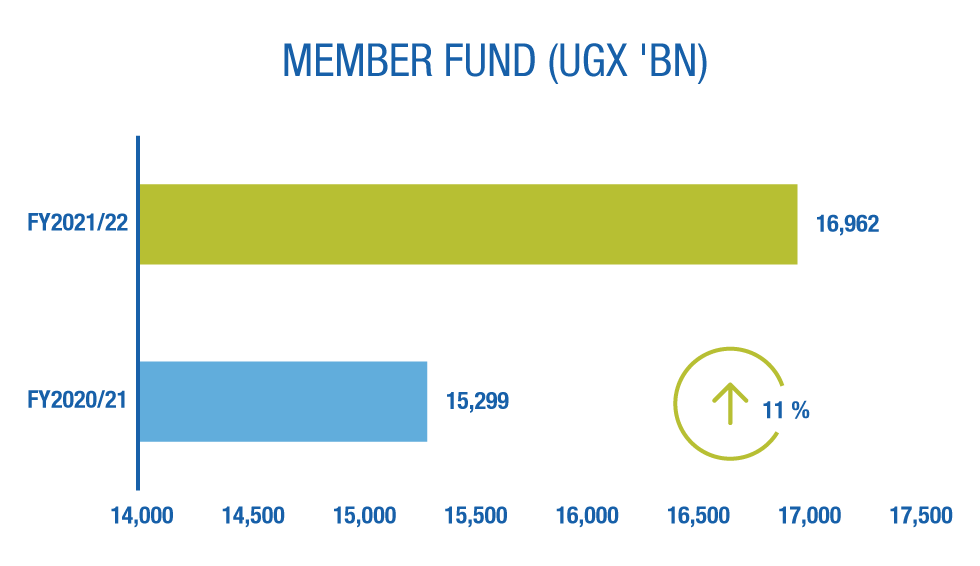

Member Fund grew by 11% to UGX 16,962Bn (FY2020/21: UGX 15,299Bn) driven by contribution collections of UGX 1,486Bn and interest credited to members of UGX 1,380Bn net of total benefits paid of UGX 1,189Bn.

The Fund invests in 3 asset classes: Fixed Income Securities, Equity Securities and Real Estate:

Member Fund grew by 11% to UGX 16,962Bn (FY2020/21: UGX 15,299Bn) driven by contribution collections of UGX 1,486Bn and interest credited to members of UGX 1,380Bn net of total benefits paid of UGX 1,189Bn.

The Tax Appeals Tribunal ruled against NSSF in March 2020 in a significant income tax matter that has been under dispute since 2013. NSSF appealed to the High Court on 2 November 2020. The High Court delivered judgment in favour of the National Social Security Fund. The court ruled that the interest paid by the Fund to its members is a deductible expense for income tax purposes and that the Fund was not liable to pay the tax assessed. The Uganda Revenue Authority (URA) was dissatisfied with the decision of the High Court and subsequently filed an application for leave to appeal and an application for stay of execution.

On 16 August 2022, the High Court dismissed the application for leave to appeal with costs, citing that it was filed outside the statutory period envisioned under Rule 40(1) of the Judicature Court of Appeal Rules. The Court further ruled that a delay of 92 days was unreasonable and there was no proper reason for the delay.

Due to the constantly evolving global business environment, the International Accounting Standards Board (IASB) which develops and approves International Financial Reporting Standards (IFRS) under the oversight of the IFRS Foundation, issued new standards and amendments to the existing ones.

Several amendments to existing standards became effective during the year. However, these had little/no impact on the Fund’s financial statements. These included the following:

We highlight further the significant accounting policies and how these affect the Fund in Note 3 of the financial statements.

The Tax Appeals Tribunal ruled against NSSF in March 2020 in a significant income tax matter that has been under dispute since 2013. NSSF appealed to the High Court on 2 November 2020. The High Court delivered judgment in favour of the National Social Security Fund. The court ruled that the interest paid by the Fund to its members is a deductible expense for income tax purposes and that the Fund was not liable to pay the tax assessed. The Uganda Revenue Authority (URA) was dissatisfied with the decision of the High Court and subsequently filed an application for leave to appeal and an application for stay of execution.

On 16 August 2022, the High Court dismissed the application for leave to appeal with costs, citing that it was filed outside the statutory period envisioned under Rule 40(1) of the Judicature Court of Appeal Rules. The Court further ruled that a delay of 92 days was unreasonable and there was no proper reason for the delay.

Due to the constantly evolving global business environment, the International Accounting Standards Board (IASB) which develops and approves International Financial Reporting Standards (IFRS) under the oversight of the IFRS Foundation, issued new standards and amendments to the existing ones.

Several amendments to existing standards became effective during the year. However, these had little/no impact on the Fund’s financial statements. These included the following:

We highlight further the significant accounting policies and how these affect the Fund in Note 3 of the financial statements.