Menu

Material matters are those issues that could substantially affect our ability to create value in the short, medium and long term. These matters influence our strategy and how we manage our associated risks, as well as opportunities we explore as a result of these factors.

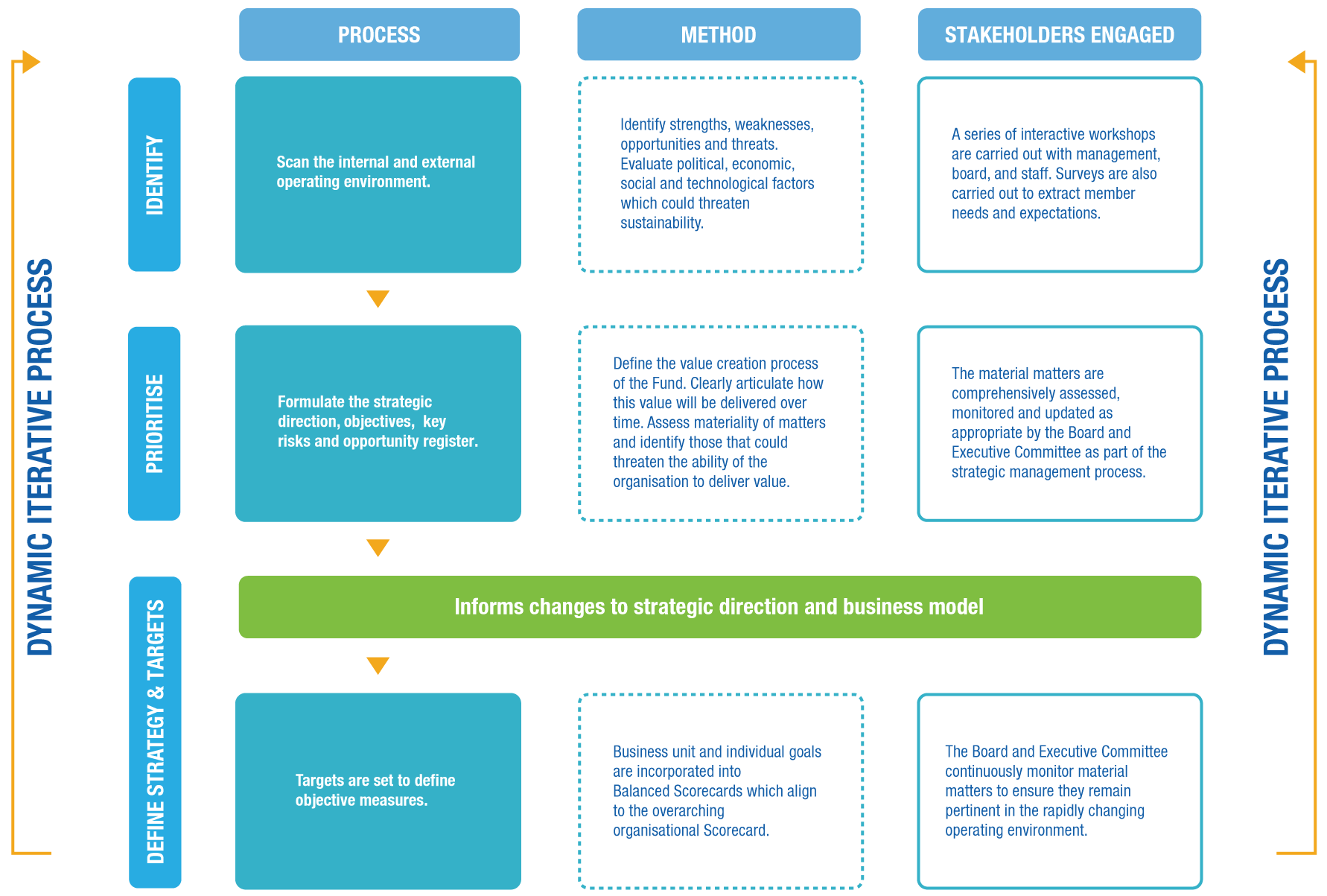

The process we follow to determine our material matters is as follows:

The outcomes of our materiality process resulted in the prioritisation of the following materiality themes:

The NSSF Amendment Act 2022 was passed into law in January 2022.

The Fund is now mandated by law to provide social security services to all workers in formal and informal employment under the private sector. Under provisions of the NSSF Amendment Act 2022 anyone can now save with NSSF for their retirement.

Reputation Risk

Liquidity Risk

Global economic uncertainty is due to the enduring effects of Covid-19, rising inflation because of the War on Ukraine, increased commodity prices, supply chain disruptions and the increasing impact of climate change.

Business/Strategic Risk

The Fund is undergoing an organisational restructure to transform the Fund into an agile and digital organisation that proactively anticipates and quickly responds to our members’ needs and delivers an exceptional customer experience.

People Risk

Operational Risk

The Fund implemented new robust core pension system in December 2021 to improve efficiencies, enable product innovation and create a seamless experience for our customers.

Business/Strategic Risk